How Vancouver Tax Accounting Company can Save You Time, Stress, and Money.

Wiki Article

Not known Details About Small Business Accountant Vancouver

Table of ContentsLittle Known Questions About Tax Accountant In Vancouver, Bc.The Small Business Accounting Service In Vancouver StatementsThe 20-Second Trick For Cfo Company VancouverFacts About Vancouver Tax Accounting Company Uncovered6 Simple Techniques For Vancouver Tax Accounting CompanyRumored Buzz on Small Business Accountant Vancouver

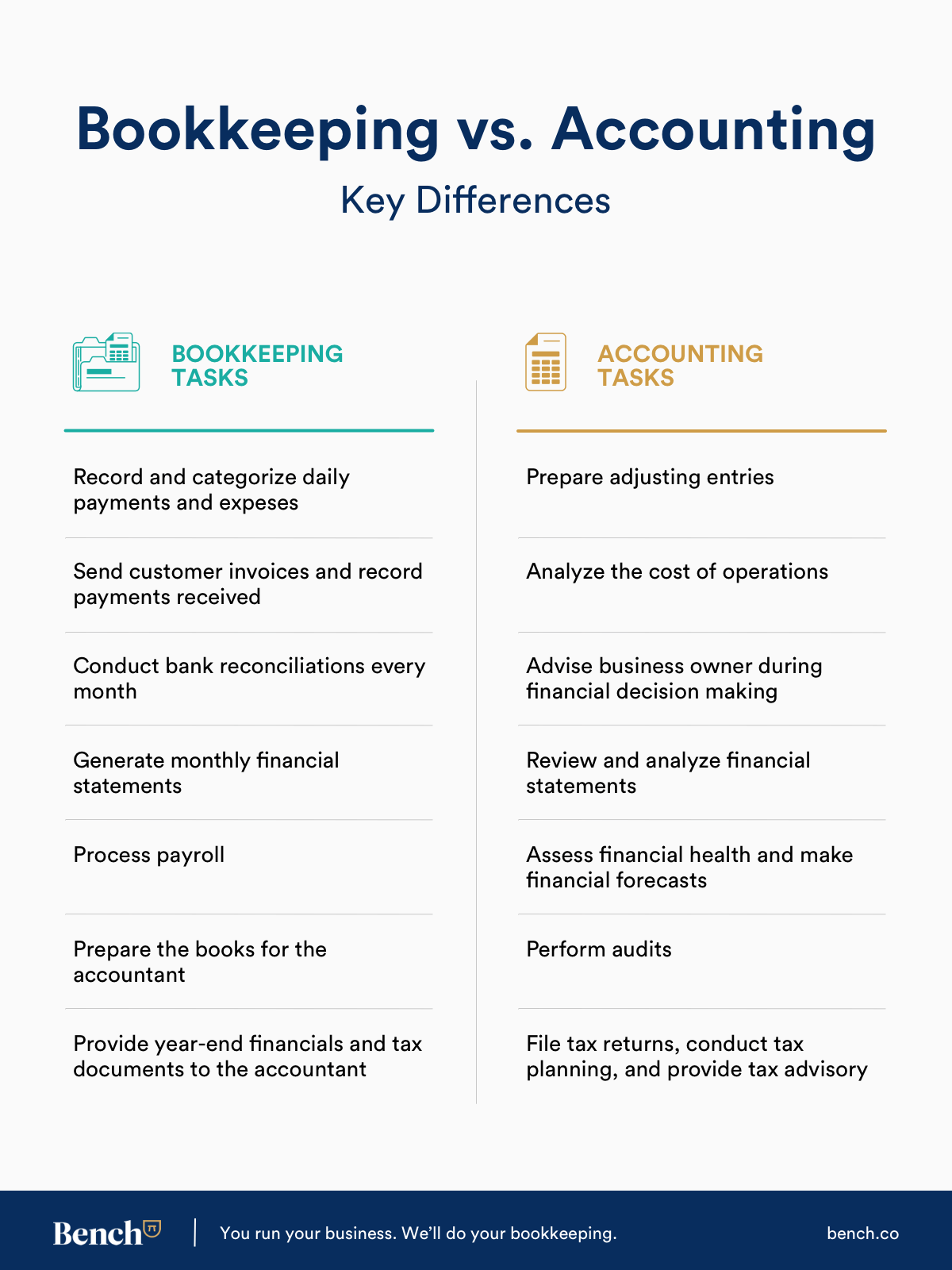

Right here are some benefits to hiring an accountant over a bookkeeper: An accounting professional can give you a thorough view of your organization's economic state, along with approaches as well as recommendations for making financial decisions. Meanwhile, accountants are just accountable for videotaping economic purchases. Accounting professionals are required to complete even more education, qualifications and also job experience than bookkeepers.

It can be tough to gauge the suitable time to employ an audit professional or accountant or to determine if you require one at all. While several tiny companies work with an accountant as an expert, you have a number of alternatives for dealing with financial jobs. Some small business proprietors do their very own bookkeeping on software application their accountant advises or makes use of, supplying it to the accountant on an once a week, month-to-month or quarterly basis for activity.

It may take some background research study to locate an appropriate bookkeeper due to the fact that, unlike accountants, they are not needed to hold an expert qualification. A strong recommendation from a relied on coworker or years of experience are important factors when employing a bookkeeper.

Little Known Questions About Virtual Cfo In Vancouver.

For small companies, proficient cash money administration is a critical element of survival as well as growth, so it's wise to work with a monetary specialist from the beginning. If you prefer to go it alone, take into consideration beginning with accountancy software program and also keeping your books meticulously up to day. This way, should you need to employ a specialist down the line, they will certainly have exposure into the complete monetary history of your business.

Some source interviews were conducted for a previous version of this write-up.

Get This Report on Cfo Company Vancouver

When it concerns the ins as well as outs of tax obligations, bookkeeping as well as money, however, it never ever hurts to have an experienced expert to resort to for guidance. A growing variety of accounting professionals are also looking after things such as money circulation projections, invoicing and HR. Ultimately, most of them are taking on CFO-like roles.Small company owners can anticipate their accounting professionals to assist with: Picking business structure that's right for you is necessary. It influences just how read more much you pay in tax obligations, the documents you need to submit as well as your personal responsibility. If you're wanting to convert to a different company structure, it could result in tax obligation consequences and other difficulties.

Also firms that are the exact same dimension and sector pay very different quantities for accounting. These expenses do not transform into money, they are required for running your service.

The smart Trick of Vancouver Tax Accounting Company That Nobody is Discussing

The typical expense of audit services for little organization differs for each distinct scenario. The More Help average regular monthly audit costs for a tiny organization will certainly climb as you add extra services and also the jobs get more difficult.You can record deals and procedure payroll using online software. Software application solutions come in all forms and also dimensions.

:max_bytes(150000):strip_icc()/forensicaccounting-Final-85cc442c185945249461779bcf6aa1d5.jpg)

How Tax Consultant Vancouver can Save You Time, Stress, and Money.

If you're a brand-new entrepreneur, don't neglect to variable accounting expenses into your budget plan. If you're a professional owner, it could be time to re-evaluate audit costs. Administrative expenses and accounting professional fees aren't the only audit expenses. outsourced CFO services. You need to likewise consider the impacts accounting will have on you as well as your time.Your time is likewise important as well as need to be considered when looking at bookkeeping prices. The time invested on accountancy jobs does not create profit.

This is not meant as legal advice; for additional information, please visit this site..

An Unbiased View of Small Business Accountant Vancouver

Report this wiki page